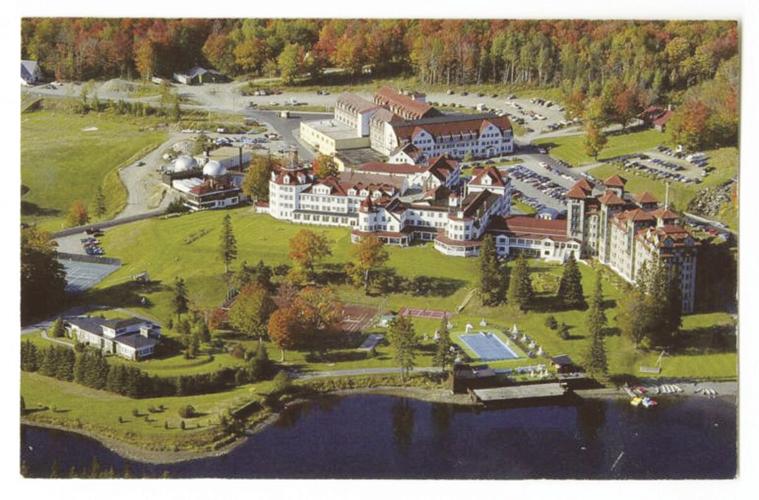

DIXVILLE — Balsams Resort developer Les Otten recently told the Coos County Planning Board that Dixville Capital LLC has spent more than $11 million on the project to restore the former ski and vacation resort.

That money has gone to permitting, architectural design, project engineering, legal fees and an extensive sales and marketing efforts. The figure does not include land acquisition costs.

kAm“$@[ H9:=6 5C:G:?8 3J E96 q2=D2>D[ :E >2J ?@E 2=H2JD 36 2AA2C6?E E92E H@C< C6>2:?D F?56CH2J @C E92E >62?:?87F= 5@==2CD 4@?E:?F6 E@ 36 DA6?E[ 3FE x H2?E E@ 2DDFC6 J@F E92E E9:D :D 4@?E:?F:?8[” ~EE6? D2:5]k^Am

kAms:IG:==6 r2A:E2= 2AA62C65 367@C6 E96 r@@D r@F?EJ !=2??:?8 q@2C5 =2DE (65?6D52J ?:89E D66<:?8 E@ 2>6?5 E96 AC@;64E’D 4@?5:E:@?2= !=2??65 &?:E s6G6=@A>6?E A6C>:E 7@C !92D6 x E@ 6IA2?5 E96 G6DE:?8 A6C:@5 3J 7:G6 J62CD]k^Am

kAm!92D6 x 42==D 7@C C656G6=@A>6?E @7 E96 w2>AD9:C6 2?5 s:I w@FD6D 2?5 6IA2?D:@? @7 E96 D<: 2C62]k^Am

kAm~EE6? D2:5 r~'xs\`h 7@C465 s:IG:==6 r2A:E2= E@ D9:7E :ED 2EE6?E:@? 2H2J 7C@> EC25:E:@?2= C6D@CE 2?5 9@DA:E2=:EJ :?G6DE@CD] w6 D2:5 2 q@DE@?\32D65 6?6C8J 677:4:6?4J AC@;64E 56G6=@A6C 92D 96=A65 C6G:D6 s:IG:==6 r2A:E2=’D 7@4FD E@ 2EEC24E H92E 2C6 <?@H? 2D t$v :?G6DE@CD] $F49 :?G6DE@CD 4@?D:56C 6?G:C@?>6?E2=[ D@4:2= 2?5 8@G6C?2?46 724E@CD :? E96:C 7:?2?4:2= 2?2=JD:D @7 AC@;64ED]k^Am

kAmpD 2 C6DF=E[ ~EE6? D2:5 7:G6 6?E:E:6D 2C6 4FCC6?E=J 5@:?8 5F6 5:=:86?46[ 2?5 EH@ @7 E9@D6 2C6 24E:G6=J 6I2>:?:?8 E96:C A6C>:ED 2?5 A=2?D]k^Am

kAm“x’> 2D 4@?7:56?E 2D x 42? C2E:@?2==J 36[ =@@<:?8 2E H92E H6VG6 925 E@ 562= H:E9[ E96 D6E324<D E92E H6VG6 925] qFE x H2?E E@ 2DDFC6 J@F E92E x C6>2:? 4@>>:EE65 E@ D66:?8 E96 AC@;64E 7@CH2C5[” 96 D2:5]k^Am

kAm~EE6? C6>:?565 E96 3@2C5 E92E :E E@@< `d J62CD 7@C {@@? |@F?E2:? E@ 4FE E96 7:CDE EC66 E@ 86E E92E D<: 2C62 F?56CH2J] w6 D2:5 8@@5 AC@;64ED 2=D@ C6BF:C6 8@@5 E:>:?8] u@C E96 7:CDE E:>6 :? EH@ @C E9C66 J62CD[ 96 D2:5 E96 E:>:?8 >2J 36 4@>:?8 E@86E96C 7@C E96 q2=D2>D]k^Am

kAmx? 255:E:@? E@ E96 S`` >:==:@? :?G6DE65 3J E96 A2CE?6CD[ ~EE6? D2:5 E96J DE:== 92G6 S`e >:==:@? :? 56A@D:ED 7C@> fb A@E6?E:2= 3FJ6CD 2?5 2?@E96C Saf >:==:@? :? 4@>>:E>6?ED]k^Am

kAmw6 D2:5 96 :D C6BF6DE:?8 E96 3@2C5 2>6?5 E96 G6DE:?8 A6C:@5 :? :ED 4@?5:E:@?2= !=2??65 &?:E s6G6=@A>6?E A6C>:E 7C@> 7:G6 J62CD E@ `_ J62CD] %96 G6DE:?8 A6C:@5 AC@E64ED E96 AC@;64E 7C@> 2?J 492?86D :? DF35:G:D:@? C68F=2E:@?D[ D:E6 A=2? C68F=2E:@?D @C E96 K@?:?8 @C5:?2?46 5FC:?8 E92E A6C:@5] %96 4FCC6?E G6DE:?8 A6C:@5 H2D D6E E@ 6IA:C6 y2?] `g[ a_a`]k^Am

kAm~EE6? D2:5 s:IG:==6 r2A:E2= H2D >2<:?8 8C62E AC@8C6DD 2E E96 368:??:?8 @7 E96 J62C @? 7:?2?4:?8[ H@C<:?8 H:E9 D@>6 H6==\<?@H? :?G6DE>6?E 32?<:?8 7:C>D @FE @7 }6H *@C< E92E 7@4FD @? E96 9@DA:E2=:EJ :?5FDECJ] (96? r~'xs 9:E[ 9@H6G6C[ 96 D2:5 2== 5:D4FDD:@?D 4@>A=6E6=J 462D65 2D E96 9@DA:E2=:EJ D64E@C 42>6 E@ 2 92=E]k^Am

kAm~EE6? D2:5 :?G6DE@CD 2C6 ?@H H2:E:?8 E@ D66 H92E 9@E6= AC@A6CE:6D H@?’E >2<6 :E H:E9 2? 6J6 E@H2C5 A:4<:?8 FA DF49 AC@A6CE:6D 7@C A6??:6D @? E96 5@==2C C2E96C E92? :?G6DE :? ?6H C6D@CED]k^Am

kAmw6 D2:5 s:IG:==6 r2A:E2= H2D 7@C465 E@ DE6A 324< 2?5 4@?D:56C :ED @AE:@?D[ :?4=F5:?8 H96E96C :E H2D E:>6 E@ 232?5@? E96 AC@;64E]k^Am

kAmpC@F?5 E92E E:>6[ ~EE6? D2:5 96 C646:G65 2 42== 7C@> s@F8=2D u@J[ 7@C>6C 9625 @7 E96 r@?D6CG2E:@? {2H u@F?52E:@? 2?5 2 H6==\<?@H? 6?G:C@?>6?E2=:DE]k^Am

kAm~EE6? D2:5 96 925 H@C<65 H:E9 u@J 23@FE bd J62CD 28@ @? 2 AC@;64E :? |2:?6 3FE 925 ?@E DA@<6? E@ 9:> D:?46]k^Am

kAmu@J :D ?@H 492:C @7 E96 3@2C5 @7 #6?6H t?6C8J !2CE?6CD[ H9:49 DA64:2=:K6D :? 96=A:?8 H:E9 7F?5:?8[ :?DE2==:?8 2?5 >2?28:?8 6?6C8J 677:4:6?4J 2?5 @?\D:E6 4=62? A@H6C 86?6C2E:@?]k^Am

kAmw6 E@=5 ~EE6? 96 925 366? H2E49:?8 E96 q2=D2>D AC@;64E 2?5 DF886DE65 #6?6H t?6C8J 4@F=5 96=A H:E9 6?6C8J 677:4:6?4J 2?5 H:E9 @3E2:?:?8 t$v :>A24E 7:?2?4:?8]k^Am

kAmuC@> u63CF2CJ E@ yF?6[ ~EE6? D2:5 E96J H@C<65 H:E9 #6?6H t?6C8J E@ C6H@C< E96 A=2?D E@ C65F46 :ED 42C3@? 7@@EAC:?E 2?5 2==@H :E E@ @A6C2E6 E@E2==J @? C6?6H23=6 6?6C8J] #6?6H t?6C8J H@F=5 96=A DFAA=J E96 C6D@CE H:E9 `__ A6C46?E C6?6H23=6 6?6C8J]k^Am

kAm~EE6? D2:5 A2CE @7 E92E H@F=5 36 #6?6H t?6C8JVD :?G6DE>6?E :? E96 C6D@CE’D 962E:?8 A=2?E] w6 D2:5 E96J 2C6 A=2??:?8 2? @?\D:E6 H@@5 49:A A=2?E E92E AC@G:56 7@C 3@E9 962E 2?5 4@@=:?8]k^Am

kAmt$v :>A24E :?G6DE@CD =@@< E@ :?G6DE :? AC@;64ED E92E H@F=5 92G6 2 >62DFC23=6 A@D:E:G6 67764E @? E96 6?G:C@?>6?E 2?5 4@>>F?:E:6D] x? 255:E:@? E@ :ED 7@4FD @? C6?6H23=6 6?6C8J[ E96 q2=D2> !92D6 x AC@;64E H@F=5 4C62E6 c__ ;@3D 2?5 86?6C2E6 D:8?:7:42?E E2I C6G6?F6 7@C E96 DE2E6 2?5 4@F?EJ :? 2? 64@?@>:42==J 56AC6DD65 2C62]k^Am

kAm!=2??:?8 3@2C5 >6>36C |:4926= (2556== 2D<65 ~EE6? :7 E96J 92G6 DE2CE65 2?J 4@?DECF4E:@? @? D:E6]k^Am

kAmw6 C6A=:65 E96J 92G6 ?@E 3FE 92G6 >2:?E2:?65 E96 8@=7 4@FCD6 2?5 @A6?65 FA E96 w2=6 w@FD6]k^Am

kAm~EE6? A@:?E65 @FE E92E E96J 2C6 A2J:?8 E2I6D @? E96 AC@A6CEJ 2?5 6>A=@J:?8 DE277[ 2?5 2C6 24E:G6=J H@C<:?8 @? H92E :E 2 =2C86 2?5 4@>A=6I AC@;64E]k^Am

kAmw6 D2:5 s:IG:==6 r2A:E2= :D DA6?5:?8 Sbbg[___ 2??F2==J @? DE277 2?5 >2:?E2:?:?8 E96 AC@A6CEJ]k^Am

kAm(2556== D2:5 96 5:5 ?@E E9:?< 8:G:?8 s:IG:==6 r2A:E2= 2?@E96C 7:G6 J62CD H2D :? E96 36DE :?E6C6DE @7 E96 4@F?EJ] w6 >@G65 E@ 2>6?5 E96 28C66>6?E 7@C E9C66 J62CD 3FE E96 >@E:@? 72:=65 E@ 86E 2 D64@?5]k^Am

kAmq@2C5 >6>36C |2C< uC2?< D2:5 :E :D 2 4C2KJ E:>6 7@C 56G6=@A6CD H:E9 E96 A2?56>:4 DE:== DFC8:?8] w6 >@G65 E92E E96 G6DE:?8 A6C:@5 36 6IE6?565 7@FC J62CD[ 2?5 E96 3@2C5 A2DD65 E96 >@E:@? F?2?:>@FD=J]k^Am

(0) comments

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.